Perfect Tips About How To Build Your Credit When You Have No Credit

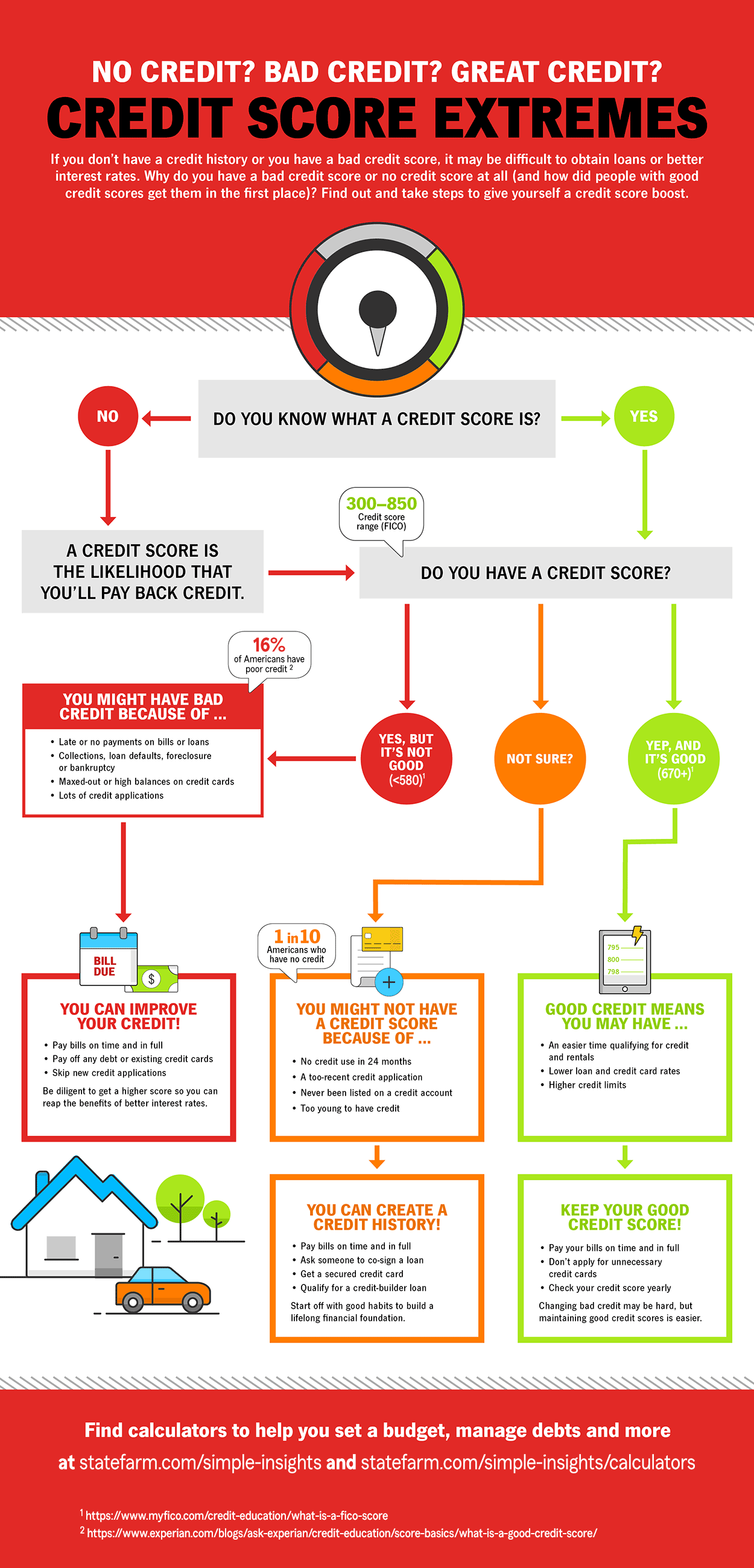

Don't have too many credit cards and make sure payments are made on time.

How to build your credit when you have no credit. Apply for a secured credit card to build credit the easiest way to start. The issuer will usually ask for a deposit between. Here are three rules you’ll want to follow when it comes to your credit card accounts.

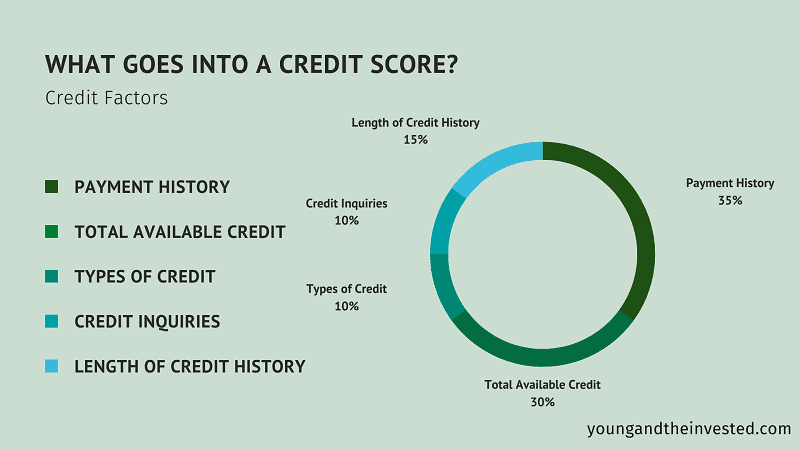

Here’s the exact breakdown, along with how much each. Some of the best ways to improve your credit score quickly when you have no credit history include becoming an authorized user, opening secured credit cards, or getting a. Ad responsible card use may help you build up fair or average credit.

New credit scores take effect immediately. Another way to begin to build credit with no credit history is through a secured credit card. Find a card offer now.

Let’s look at four fast ways to build a good credit score without getting into uncontrollable debt. But even with good credit, the average credit limit you can expect to get with a first credit card is generally between $500 and $1,000. Just make sure that you only spend what you can afford to.

At least one of these proven methods should boost your fico credit score: Becoming an authorized user on a family member's or friend's credit card is one way to build credit that doesn't involve applying for your own credit card. If you have fair credit, expect.

However, the best way to improve your score is to be consistent with. Once you’ve got that banking track record, there are five options to consider: Chase ink business cash® credit card.

![Tips For Building Credit [Infographic] | Credit One Bank](https://www.creditonebank.com/content/dam/creditonebank/articles/2021/11/A_Few_Good_Ways_to_Build_Credit_Infographic.jpg)