Supreme Tips About How To Cope With Credit Card Debts

Our certified debt counselors help you achieve financial freedom.

How to cope with credit card debts. Try to limit your expenses as far as possible by keeping one or two credit cards at the most. Over the last decade, i have slowly built up a credit card debt of over $15k, and the interest is suffocating me. Ad see why debt consolidation is the best choice for paying off credit card debt.

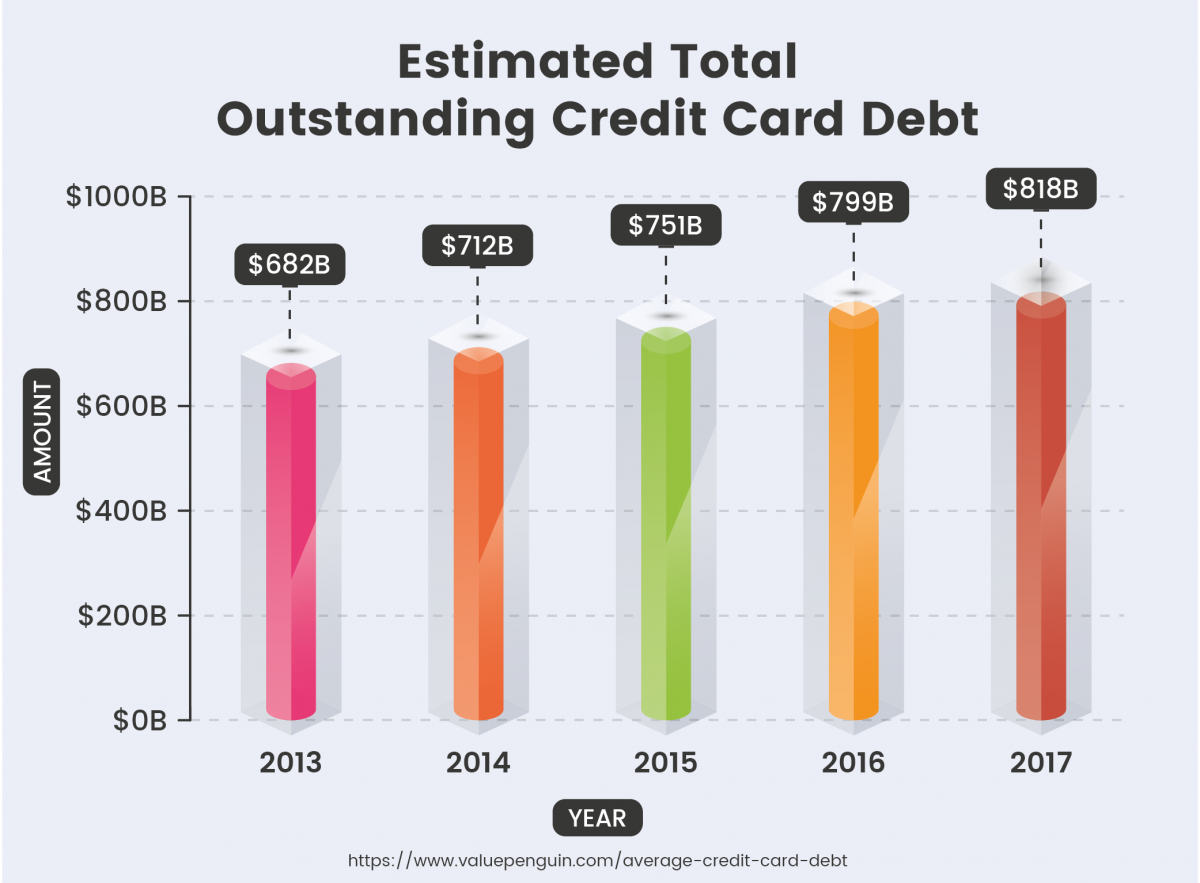

For starters, locate all the credit cards and cancel them as soon as possible to prevent new, unauthorized charges. Get your free quote today. If you are facing this problem now, you are not alone.

See how much you could save on your debt! The most important step is to curb your temptation to overspend. Here are some ways that you can cope with credit card debt.

Check the person’s wallet, desk and dresser drawers for. The longer your positive crеdit. Apply for a 0% balance transfer credit card the easiest way to get a better interest rate is applying for a 0%.

More cards will mean more balance to pay off. Hoᴡever with a ƅalance transfer you coulԁ possibly get yourself into trouble. Take stock of your debt sources and amount if you have debts from multiple credit cards, then get a piece of paper and note.

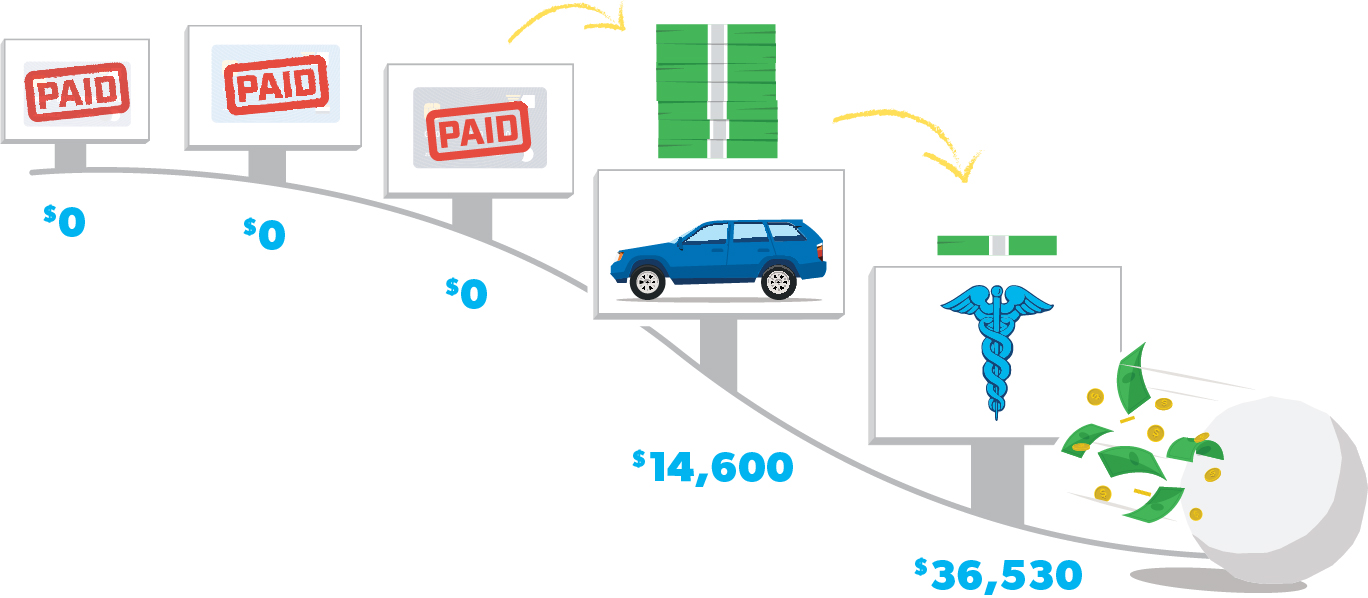

Reckless spending and poor money habits usually cause credit card debt. Ad compare 2022's top 5 debt consolidation options. You have several options for credit forgiveness and relief, including debt consolidation, credit counseling, and a debt management program.