Nice Info About How To Lower Credit Card Debt

_1.jpg?ext=.jpg)

Ad free independent reviews & ratings.

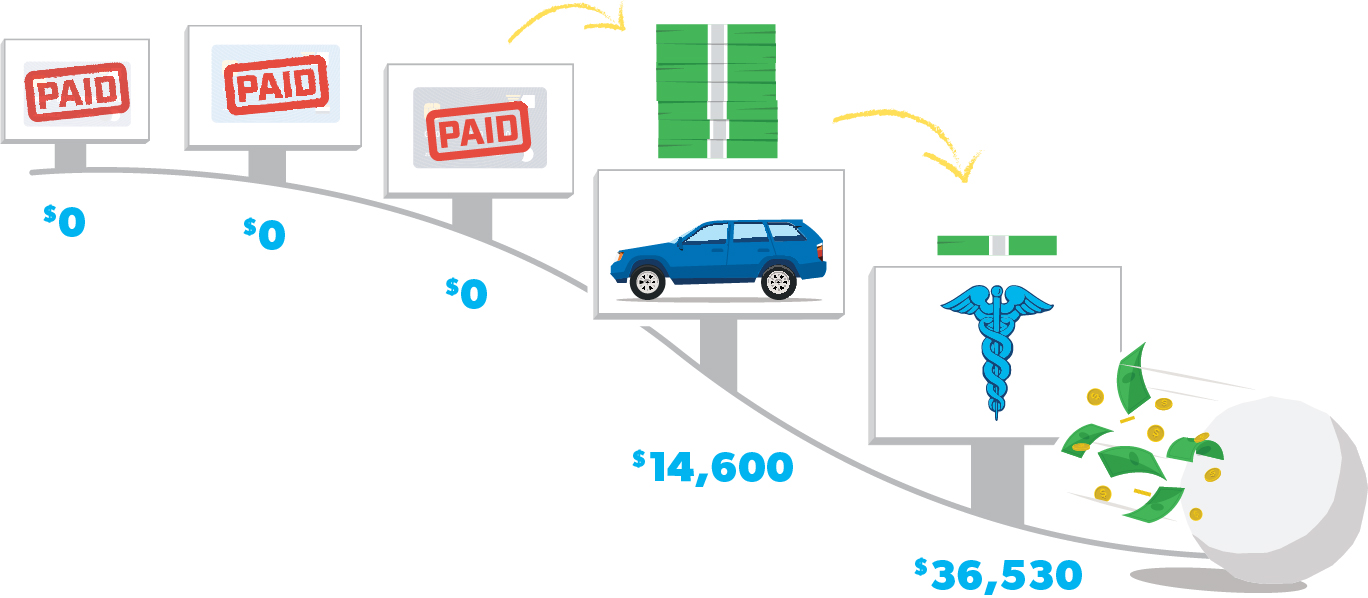

How to lower credit card debt. Pay off the debt before it expires, if you can. How to avoid credit card debt. Minimum payments mean big debt.

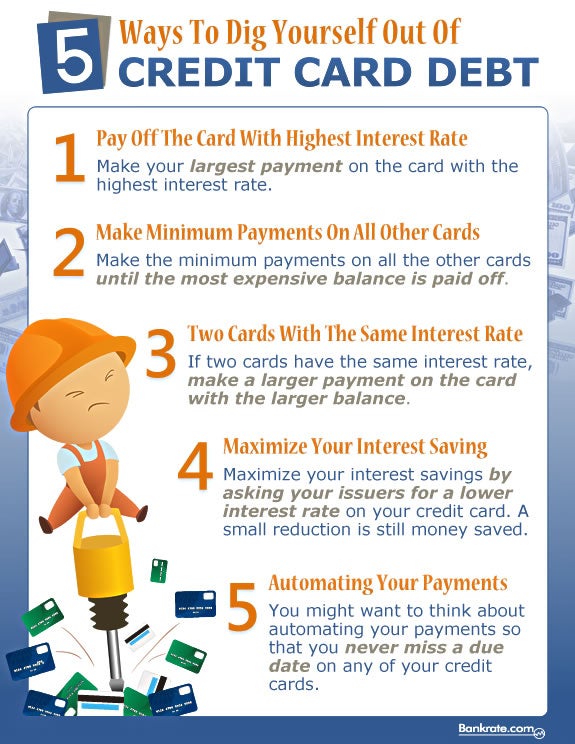

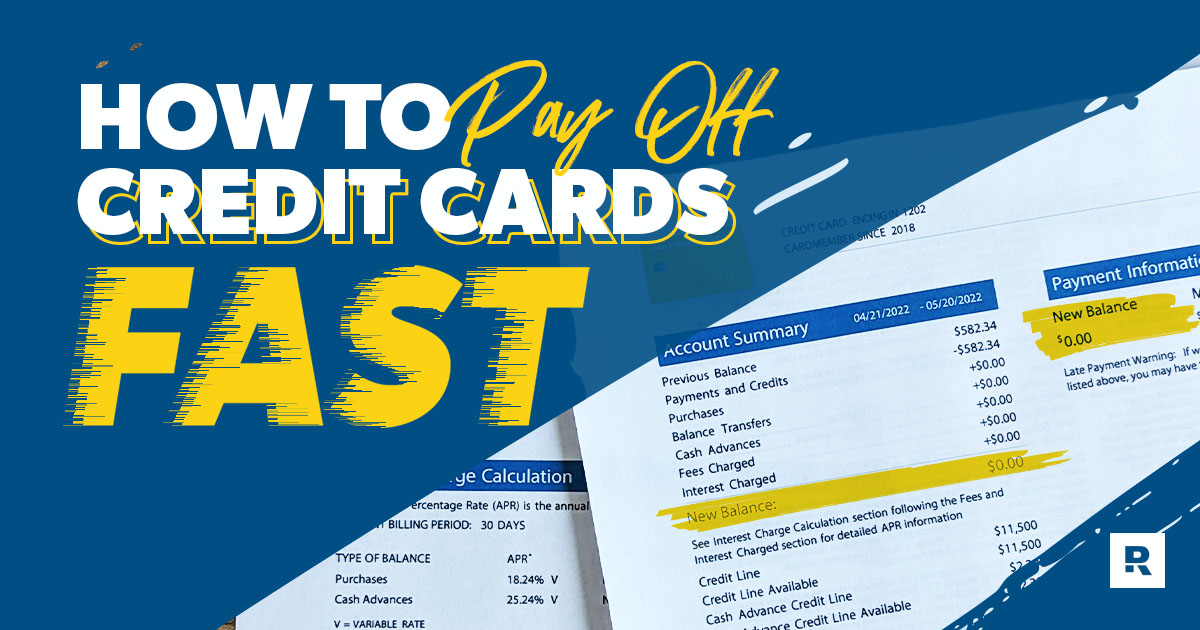

How to attack credit card debt pay more than the minimum. Whatever your situation, here are seven ways to lower your credit card debt in light of this latest fed rate hike and additional increases that probably are coming. You should immediately shop for a new credit card that offers a lower rate, experts say.

Another personal loan option is to use your home equity for a line of credit to pay off credit card debt. Earlier, we talked about the best way to pay off that credit card debt: We make it easy to get your funds in as little as 24 hours.

Ad americor® can help you get out of debt quicker. Develop the right money mindset. If you have more than one credit card, you can consolidate all your debts and pay them off with one loan.

You essentially take on a new debt that helps. Many credit cards offer a 0% introductory interest rate for a limited time. There are several different ways you can tackle your credit card debt.

How to reduce credit card debt 1. Almost 2 in 5 americans with credit cards (38%) say. Let's say you owe $5,000 on a credit card and are paying 15% interest.

:max_bytes(150000):strip_icc()/pros-cons-personal-loans-vs-credit-cards-v1-4ae1318762804355a83094fcd43edb6a.png)