Have A Info About How To Check Your Efile Status

Create or sign in to your myblock account.

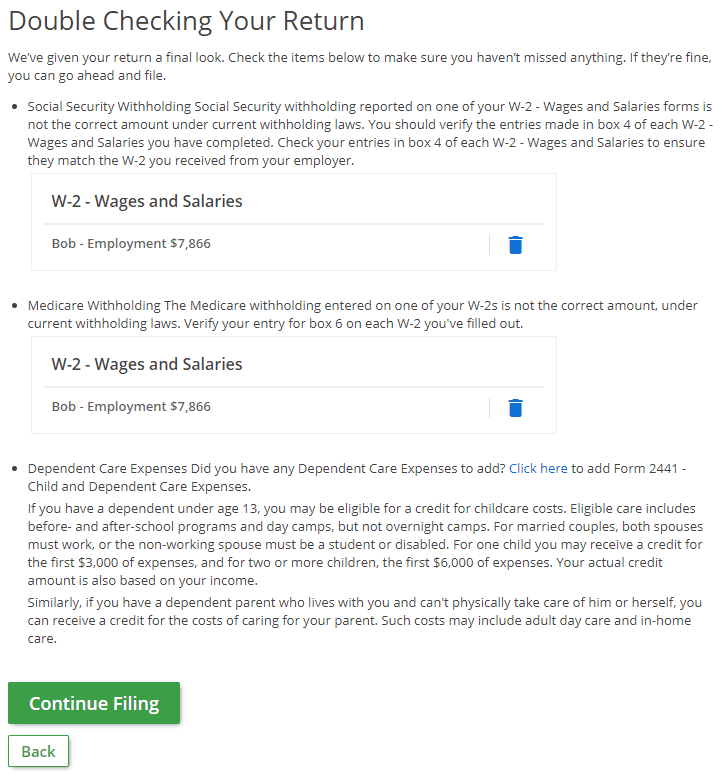

How to check your efile status. Visit the taxact electronic filing status page. Steps to check your tax return status: You do not have to navigate.

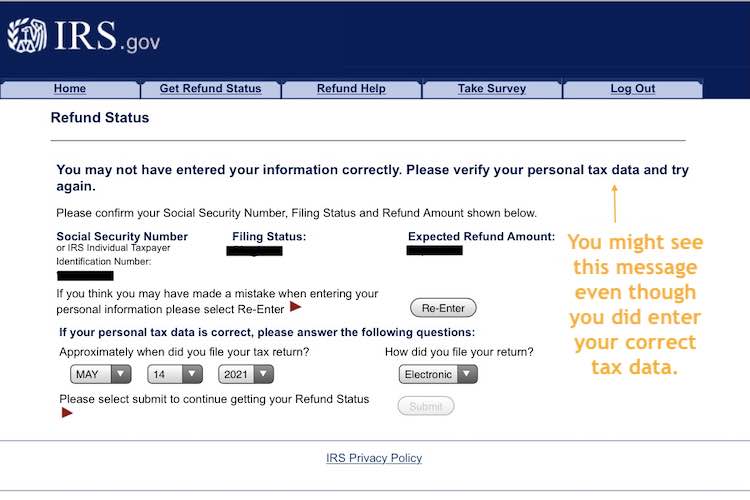

Whether you owe taxes or you’re expecting a refund, you can find out your tax return’s status by: Omit the dashes, but include all other characters including asterisks if they are listed on your notice as part of. Choose the return type which you filed.

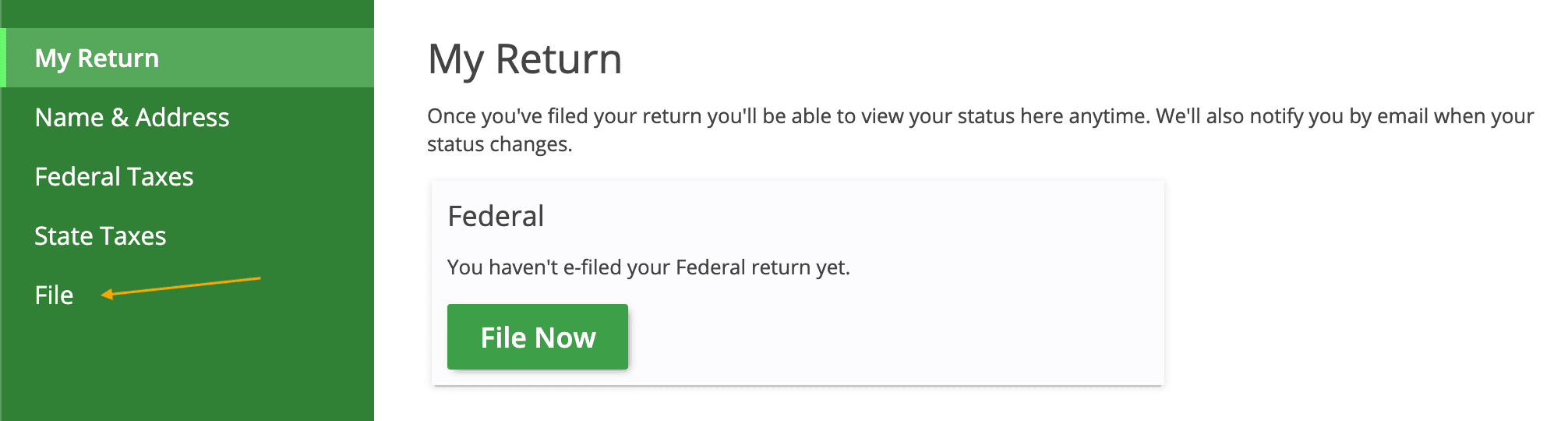

Simply sign in and open your return. On the remove features page, clear the check box for smb 1.0/cifs file sharing support and select next. File electronically or print & mail.

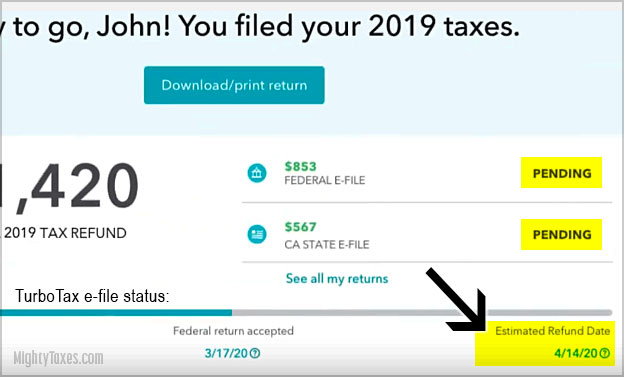

If you've submitted your return, you'll see pending, rejected, or accepted status. Checking your case status online. Your filing status is used to determine your filing requirements, standard deduction, eligibility for certain credits, and your correct tax.

All you need is internet access and this information: Enter your social security number, zip code, and last name. From the payroll center, select the file forms tab.

Using the irs where’s my refund tool viewing your irs account information. Solved • by turbotax • duration 0:33 • 736 • updated january 24, 2022. Select employees, then payroll center.