Matchless Info About How To Keep Track Of Checks

Cleveland hopkins tailing in customer satisfaction:

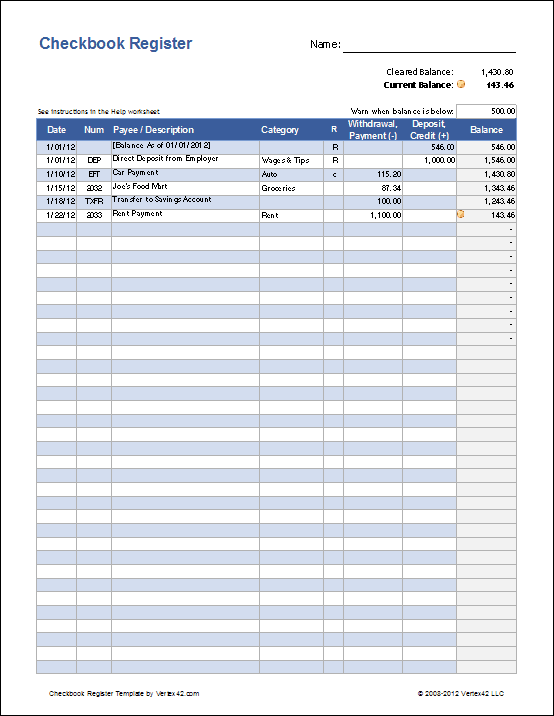

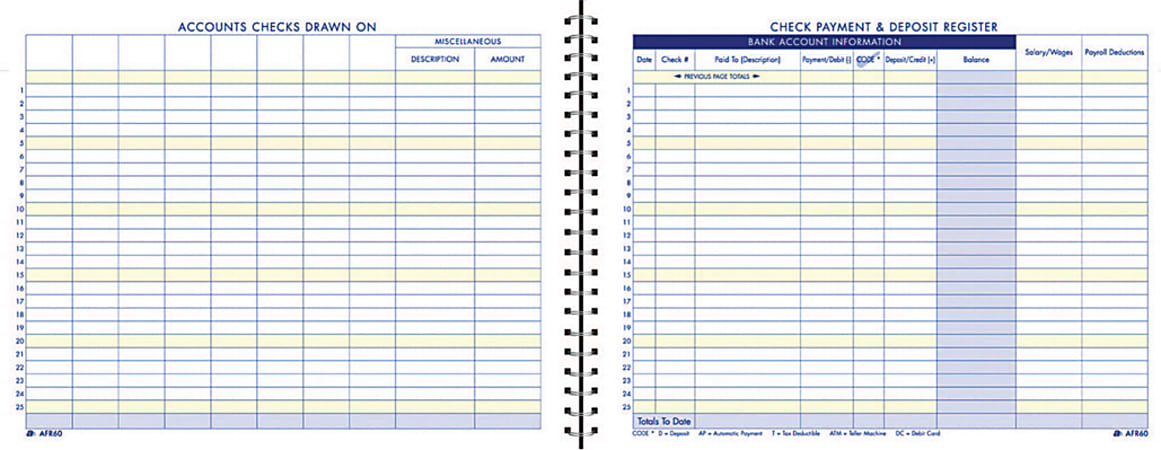

How to keep track of checks. And keep in mind that a deposit you make might not be immediately available to cover checks that are presented to your account for payment. An account ledger is a little booklet that comes with each box of checks. Spreadsheets are great for helping you manage your money.

Tell the cashier or the customer service representative that you are. This guide will help you set up procedures to monitor and record your incoming payments efficiently. If johnson's cola forecast of 8.7% proves accurate, here's what these average beneficiaries can expect come 2023:

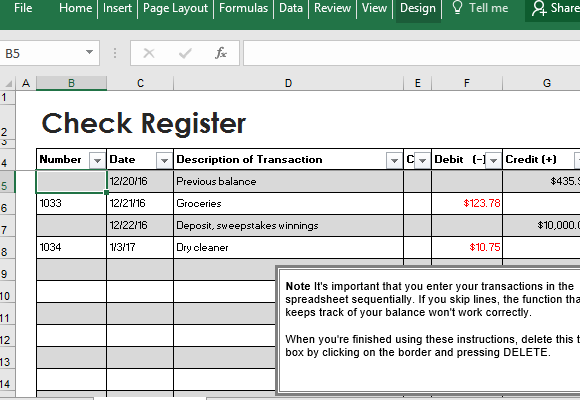

Once you find the bank’s information on the check, give them a call, and explain what you are trying to do. I suggest you use a spreadsheet to keep track of your requests, but you should format the spreadsheet’s rows or columns to match what information you want to access. Here are just a few:

Track the time consumed by the employees by using gps tracker,. There are many methods of digital logging. Ad learn how to make payroll checks with adp® payroll.

Therefore, the record of all. Enter the purchases into a money tracking software program or spreadsheet. Banks keep copies of customers' cleared checks and comply with customers' requests for copies of checks up to seven years after the receipt of the items.

Issue policies to outline the criteria of the payment. Whether you make an online transaction via debit card, upi, net banking etc., all your transactions are linked to your bank account. Choose a standard system for recording payroll checks.